Do you look before you leap?

Ashish had a good ten years in Dubai in a well-paying job when his wife wanted to get back to India as the kids were growing up. He had a healthy bank balance of over Rs.100 Lakhs. Still, in his mid-forties, Ashish decided to try his hand at entrepreneurship. He thought he would set up a retail store dealing in high-end stationery items. He had seen many such shops in Dubai and felt India just didn’t have the quality and range. He felt he could set up such a store, source the products from China and Taiwan, and start his life as an entrepreneur.

Ashish invested 25 Lakhs of his own and borrowed 50 Lakhs from a bank, putting his house as collateral. The amount was spent in setting up a shop in a prime location and stocking it with good quality stationery items. He tied up with some leading brands for supply. He was excited, his wife was supportive, his parents and in-laws were worried.

At the end of 3 years, Ashish had aged by 10 years. His average sale per month was around 10 Lakhs with a gross margin of around 20% (2 Lakhs per month). His monthly loan repayment was 1 L, his monthly expenses for staff and electricity were over 0.5 L per month. He was barely able to make Rs.40,000/- on a good month. To meet home expenses, he had to draw from savings which were fast depleting. Then Corona happened and his sales dipped to 2 L per month. The bank was after him for loan repayment. When he defaulted three months the bank manager, who he thought was his friend, started talking of stringent action.

Ashish started getting calls from private financiers – he was almost tempted to approach them.

In the fourth year, Ashish sold out his business at a distress price of Rs. 10 L to a buyer who agreed to take over his loan. Ashish was a disillusioned man. “I should have stuck to employment”, he lamented, “business is not for people like me”. He put up his profile in job portals.

***

When I met Ashish in the course of his job search, he told me his sad entrepreneurship story. I asked him a simple question:

“Did you do any analysis before you decided on your business?”

“Of course,”, said, Ashish. “I have seen many such shops in Dubai. They are making huge money. My products were the best in the market. I had invested 25 L, which I could make in two years. It was just my bad luck. Indians just don’t have the taste for good quality products”.

I asked him: “Who said you invested 25 L, what about the bank loan of 50 Lakhs you put in?” “What about the investment of your time and the collateral you provided for the loan? Don’t you think these are “investments” of sorts?”

“Ashish”, I told him, “There is nothing wrong with you or entrepreneurship. It was your approach that was faulty. You should always look before you leap.

“But how, what should I have done? Asked Ashish. Here is what I told him

***

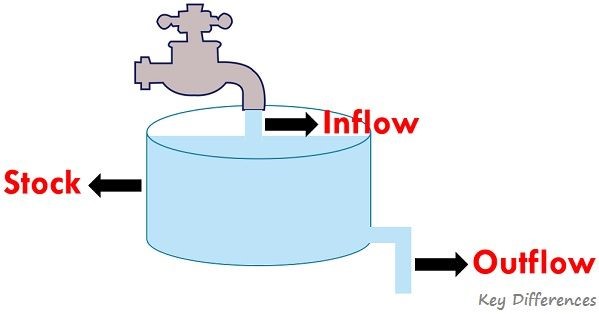

A business is like a tank where you put in some water (your investment). It has a tap from which water flows in (the revenue or sales). It has an outlet in the bottom, from which water continuously flows out (your monthly expenses or cash outflows) As long as the tank has water in it, the business is functioning. If the outflow is greater than the inflow, soon the tank will run out of water – and the business will collapse. If at any time you stop the inflow and outflows, the tank should have at least the amount of water you started with (your investment).

The stock referred to in the above image is the total amount of water (or cash) in your business at any time. The outflow is the cash that goes out of your business every month (salaries, rent, electricity, supplier payments + loan repayment). The inflow is the money that comes in (revenue + investments+ loan funding).

The equation for the business is simple. If you stop the inflow and outflow, there should still be money in the system that you can take out.

There may be money in the system – that you can’t take out. For example, you may have spent money on furnishing your shop- this is lost. You may have inventory in the system that is obsolete or damaged or that cannot be sold. You may have outstanding from customers that you can never collect. All this money appears to be there – but you cannot retrieve it.

A healthy business is one where you have money that you can easily recover. This must be more than what you put in. This is the simple analysis that all businesses must do before they start. Project your inflows and outflows for 24 months. Ask yourself the question – after 24 months will my tank run dry? Or will there be money I can recover if I want? If the answer is NO, or even doubtful – Do Not Go Ahead.

This is a very simple exercise. The question is how much money should I have left with me at the end of 24 months? Is it what I put in, or should it be 50 % more? There are simple ways to answer these questions.

***

Let us take the case of Ashok. He put in Rs.75 Lakhs (25 L of his own + 50 Lakhs from the bank). The first question he must ask himself is – When will I get my money back? After all, you have put in money, you must at least get it back. This is the concept of the payback period.

The payback period is the number of months or years within which you get your money back if your business performs as planned. For example, assume you invested Rs.100 L in your business. After estimating all expected incomes and subtracting all expected expenses, let us say you are left with an average figure of Rs.2 L + per month. This means you make about Rs.25 L per year from your business. You will get back the Rs.100 L invested in 5 years. The payback period is 5 Years.

Of course, there are other complications like income tax and tax shield on interest repayment, etc. We will not get into these for the moment. A thumb rule calculation tells you that your business will give you back your investment in 5 years. This is a great place to start.

This is just a first-level, dipstick evaluation of a business. There is a more complex analysis that you need to do before you invest. But, at the very minimum, your business idea must give you a reasonable payback period. If not, it is wise to abandon the idea in its current form.

***